Important Things a Payroll Service Should Do For Your Company

Make running payroll a breeze

The right service should do everything they can to help reduce the stress and hassle of running payroll by helping you to:

Centralize your record keeping so you’re not maintaining employee data in separate systems

Minimize the amount of data you need to enter to ensure greater accuracy

Ensure you never over-contribute and are confident employee cost-sharing programs are always on target

Eliminate all of your reconciliation headaches

Give you warnings on potential errors before you finalize payroll

Save time

Your time is valuable, and that means you should be able to save time and pay your employees faster. That means your payroll service should help you to:

Settle payroll discrepancies swiftly with your employees

Create time-saving formulas to handle commissions, benefits deductions, bonuses and RRSP matching

Automate your T4s, remittances, and ROEs

Integrate seamlessly with other mission-critical applications, including HR, benefits, and time and attendance, so any change you make to employee data is reflected instantly everywhere with no extra effort on your part

Reduce your risk

Another reason for choosing a payroll service is to reduce your overall risk. Your provider should make it easy to:

Accurately calculate, file, and pay payroll taxes

Ensure you are always remitting taxes accurately and on time according to federal and provincial laws

Align with employment standards with 100% compliance for vacation, overtime, and statutory holiday pay

Get a clear picture of your business

Your payroll solution should provide you with a high degree of visibility into your business. That means you should be able to:

Access unlimited payroll reporting whenever you need it to help you better understand your results, inform better practices, and forecast more effectively

Create your own detailed reports that help you dig deep into your data to uncover actionable insights (including both your financial and people data)

Easily export your payroll results into your workforce management system or other mission-critical systems

Tips for Choosing a Payroll Service

Ease of Use and Accessibility:

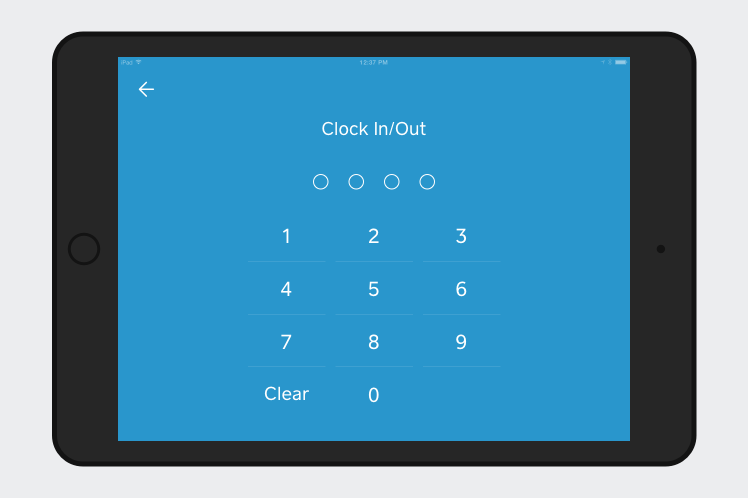

Most payroll services today allow access to a secure site for employees to view their individual payroll history. Having a password-protected website to view and print pay stubs, review payroll history and keep track of sick, personal and vacation days provides a better service for your employees. Having this information at their fingertips will also decrease the number of payroll questions you have to answer.

A web-based payroll system, though commonplace, is not the only way you can provide the information for payroll. Some payroll services require phone-ins at a specific date and time which can be very inconvenient for the ever-changing schedule. There is also the option to fax or e-mail. But being able to enter information anytime, anywhere from a web browser gives you an opportunity to double-check that all the information is correct and easily make adjustments. Once you determine which medium of communication works best for you, find out whether the provider can accommodate those needs. Providing information for the payroll service should not be complex and a hassle but easy and convenient. Remember a payroll service is supposed to alleviate stress.

Responsibility and Customer Service:

A payroll service that is frequently making mistakes can be the source of great frustration. And although you should only sign with a provider that guarantees they will absorb the costs of their mistakes, you do not want to worry about whose check will be incorrect next payday. As mentioned previously you should ask each payroll service for references from similar accounts. Check with these companies the accuracy, integrity, response time, professionalism and customer service of the provider.

Everyone makes mistakes; even the best payroll services can make a mistake at some point in time. What defines the company is how they react to their error and whether or not responsibility is taken. Ask them how quickly new checks will be provided if a mistake is made. And make sure the payroll service is liable for tax mistakes since the penalties for such a mistake can be very steep.

Customer service is also key. You do not want to hold for 20 minutes on the phone only to reach someone unfamiliar with your account and therefore unable to answer your question. Find out if there are other options besides calling to receive help or answers. Perhaps they can respond sooner to e-mails?

Who Will Handle Your Account?

Last but certainly not least is to find out who will be handling your account. You may have met with the experienced head honcho as you signed the dotted line but once you leave he assigns your account to an inexperienced intern. Once you find out who will be in charge of your account make sure it is someone you feel comfortable with, and someone who encourages you to ask questions. You will be dealing with this individual on a regular basis and you do not want to work with someone who makes you feel uncomfortable every time you do not understand something.

How to Choose a Payroll Service

How to Choose a Payroll Service: Where to Look

A simple Google search of “payroll service” yields about 485,000 results, and with so many options to choose from, narrowing down those results can be just as difficult as crunching numbers yourself.

Adam Spiegel, a certified public accountant and partner with Morrison, Brown, Argiz & Farra LLP, says getting a referral from someone you trust is the smart way to start your search. “You’ve got to discuss what you’re doing with a controller, a CFO, an outside CPA or an attorney who can advise you,” he says.

You might also try getting references from other similar businesses in your area. Pat Carson, founder of the San Jose-based bookkeeping and accounting firm Carson & Crew, says, “There will be folks who absolutely love the service they have and would be very willing to recommend people.”

The larger services Carson suggests are Intuit Online Payroll, ADP and Paychex, but, she warns, it’s important to realize that some large services may try to bundle your payroll package with additional services that you might not need, like human resources capabilities. This could drive up your monthly costs.

To make sure you’re not getting over-served, Carson suggests mapping out a list of services you expect your company will use over the course of a year. Ask yourself questions like how much you plan on growing, how many full-time, part-time and contract employees you’ll have on your payroll throughout the year, and if anyone is due for a raise or bonus. Decide whether or not you’ll need a company that can handle different state and federal taxes. Do you need human resources services in addition to payroll? How much can you afford to pay the service? Will you be offering employees 401(k)s and other deductions? How often do you want to issue paychecks?

How to do Payroll Taxes and Process Payroll Yourself

How to Process Payroll Yourself

Summary: Low cost but time consuming and prone to errors.

If you’re tax savvy, you may be able to take on a DIY approach to paying your employees. But given all the payroll mistakes you can make (and nasty fines you can incur as a result), make sure you’re completely comfortable with everything you need to do before you dive in.

To get started:

Step 1: Have all employees complete a W-4. To get paid, employees need to complete Form W-4 to document their filing status and keep track of personal allowances. The more allowances or dependents workers have, the less payroll taxes are taken out of their paychecks each pay period. For each new employee you hire, you need to file a new hire report. Note that there is a new version of the Form W-4 for 2020, so this is the form you should have new hires fill out starting January 1, 2020.

Step 2: Find or sign up for Employer Identification Numbers. Before you do payroll yourself, make sure you have your Employer Identification Number (EIN) ready. An EIN is kind of like an SSN for your business and is used by the IRS to identify a business entity and anyone else who pays employees. If you don’t have one, you can apply for an EIN through Square using our free EIN assistant. You may also need to get a state EIN number; check your state’s employer resources for more details.

Tips for Successful Payroll Management Services

Implement A Paperless Payroll Process

The first and foremost rule is to opt for paperless payroll management services.

By eliminating paper processing, payroll companies can save time as well as resources. The cost of issuing one paper check is estimated at $3. So if you are looking for ways to cut costs and at the same time, maintain the security of company data, then going paperless is the best way to achieve that.

Install The Right Software

With the advent of technology, you can now easily automate most of your payroll management services. Managing payroll has become easier than ever.

However, the trick lies in selecting and installing the right software suited for your business. There are many types of software available in the market — you can either choose directly from the shelf or have bespoke software developed as per your business needs.

Align Your Different Pay Schedules

When you are looking to effectively manage your payroll processes, it’s essential to stay organized.

Many companies maintain a different pay schedule, mainly weekly, biweekly, semi-monthly, and monthly. You can even pay more frequently if you desire. But in practice, it leads to more errors and increases the likelihood of duplication of multiple processes.

Get Proper Training in Payroll Management Services

The process of payroll management is constantly evolving, and you might especially see a variety of changes in federal and state laws.

Streamline Your Payroll System With Other Existing Systems

The first rule of buying a payroll software is to check whether it will be compatible with your already existing systems. If not, then it can create several problems for you.

For starters, the payroll system must integrate with your accounting system. It makes it easy to calculate and process the payments accurately.HR professionals need to continually educate themselves on the critical aspects of their role. They need to stay up-to-date with the technology progresses, demands on the HR department shifts, and several other related services.